At the Intersection of Asset Management and ESG

The Importance of Environment, Social, and Governance Principles in an Asset-Intensive Setting

Overview

When asset management practices intersect with Environment, Social, and Governance (ESG) principles, the result is an ESG culture that is pervasive throughout an asset-intensive business setting. Such a culture powerfully impacts day-to-day operational tasks that comply with regulatory standards ─ while also enhancing overall performance and profitability ─ underpinned by a thoughtfully designed and diligently enforced ESG program.

Simply put, the deep thinking and organization competencies that deliver meaningful and sustained ESG are well aligned with the goals and objectives of comprehensive asset management. Based on our experience, Allied has observed that companies who view asset management as a vehicle to achieve and maintain ESG success, virtually have their cake and eat it, too, in terms of both asset reliability and social responsibility.

Corporate Social Responsibility

At a high level, corporate social responsibility refers to practices and policies undertaken by corporations that are intended to have a positive influence on the world. Along these same lines, there is a growing desire in many organizations to practice ESG principles in their everyday business operations. In fact, such practical applications of corporate responsibility are increasingly viewed as necessary and of strategic importance to a company’s success.

Mapping ESG to Asset Management

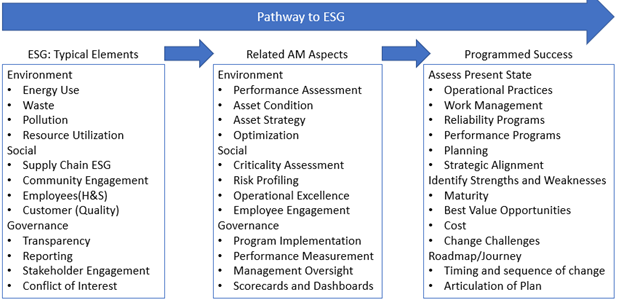

The below chart shows how ESG and asset management competencies are intrinsically related:

Implementing a Successful ESG Program

Although the drivers for adopting ESG principles may vary from company to company, the implementations tend to follow similar paths that include executive and board-level activities, as well as operational activities. Developers of successful ESG programs understand that ESG maturity should be in step with asset management maturity ─ working in sync to deliver improved performance, reliability, risk management, and positive effects on other strategic goals.

A strong ESG program requires insight into how fundamental business activities and decision-making are managed to ensure:

- Employee and public health and safety is top priority

- The environment is respected

- Operational impacts on the community are understood, and the public is engaged

- Management oversight systems accurately represent facts on the ground and enable course correction

Most pathways to achieving ESG goals are clearly aspects of asset management. For example, enhancing maintenance and operating practices will result in better performance, greater efficiency, less waste, or even better safety. The below diagram depicts an effective pathway to ESG.

ESG Challenges & Outcomes

Identifying asset management competencies necessary to achieve specific ESG goals may not be that difficult. However, what is more challenging for many organizations is assessing their present state, designing roadmaps, and deploying the right resources to the right place, at the right time. This involves doing due diligence evaluations of existing work processes and planning/designing new ones to reach the desired level of ESG.

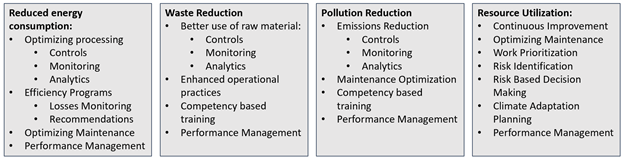

The effort is well worth it, as the following key ESG outcomes can be expected:

- Reduced energy consumption

- Waste reduction

- Pollution reduction

- Optimum resource utilization

Summary

The essence of ESG is about enhancing environmental performance and being more responsible operationally every day. It is also about improving the ability to foresee environmental and social risks in the medium and long term and applying these concerns to a risk-based, decision-making approach. An approach that inherently includes environmental and social concerns, goals, and objectives alongside (and with appropriate ranking) other strategic goals and objectives (safety, profitability, quality, and so forth). Asset management provides the key ingredients, including Criticality Assessment, Maintenance Strategy, Predictive Maintenance (PdM), Condition Monitoring, Risk-Based Decision Making, and much more.

For detailed information, refer to the first in a series of Asset Management Enabling Environment, Social, and Governance (ESG) Principles white papers.

Ask us about how we can assist with creating a reliable ESG program for your company.

ABOUT ALLIED RELIABILITY

Allied Reliability provides asset management consulting and predictive maintenance solutions across the lifecycle of your production assets to deliver required throughput at lowest operating cost while managing asset risk. We do this by partnering with our clients, applying our proven asset management methodology, and leveraging decades of practitioner experience across more verticals than any other provider. Our asset management solutions include Consulting & Training, Condition-based Maintenance, Industrial Staffing, Electrical Services, and Machine Reliability.

Subscribe to our Blog

Receive the latest insights on reliability, maintenance, and asset management best practices.