Designing the Journey

Let us help you get started by registering for our one-day executive ESG Consulting Workshop.

Manage ESG risk and deliver throughput at the lowest operating cost while achieving ESG objectives.

There is a growing desire in many organizations to practice environmental, social, and governance (ESG) principles in everyday business operations.

The challenge is to overcome complexities associated with operationalizing the effort so that the purpose and intent are embraced throughout the organization and sustainable in day-to-day tasks. This is where Allied Reliability has exceeded for years: effective change management to ensure new maintenance and reliability approaches are understood and adopted.

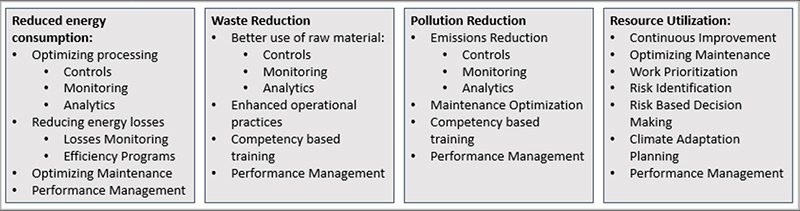

Applying asset management competencies to achieve ESG goals is not complex; however, assessing present state, designing roadmaps, and deploying these competencies can be challenging. To help, we’ve mapped the connection between asset management performance and ESG objectives. Taken together with our proven asset performance methodology, we can help ensure successful achievement of your goals.

Let us help you get started by registering for our one-day executive ESG Consulting Workshop.

Many ESG objectives are enabled by common AM competencies, as indicated in the above graphic. Doing due diligence (designing a plan and measuring/achieving compliance) is of utmost importance, as it will result in operational effectiveness, reliability, and profitability. ESG and AM are intrinsically related and, along with traditional success measures, can be a win-win proposition.

Some key environment outcomes related to ESG are detailed below. They include:

Operational and business activities that drive environmental outcomes.

It is natural to associate environmental performance with good operating and maintenance practices. But the goal should be enhancing environmental performance and being more responsible operationally every day. It is also about improving the ability to foresee environmental and social risks in the medium and long term and applying these concerns to a risk-based, decision-making approach. An approach that inherently includes environmental and social concerns, goals, and objectives alongside other strategic goals and objectives (safety, profitability, quality, and so forth).

In this context, the question becomes: How does the organization mature to better represent environmental values? The short answer is that the asset management discipline provides the key ingredients including criticality assessment, maintenance strategy, condition-based maintenance (CBM), risk-based decision making, and much more. To learn more, download our white paper, Designing ESG within an Asset Management Framework.

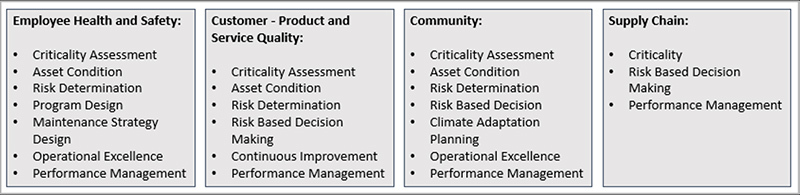

Social responsibility is a key characteristic of ESG-compliant organizations. While some important activities are related to corporate engagement and support for community-based initiatives (to name a few), there are important operationally focused business activities related to these aspects, as shown below.

As in the environmental stream, it is notable that there is an essential AM contribution to enhancing and applying an organization’s commitment to social responsibility.

Certainly, it is necessary to have a deep understanding of how assets (their condition and performance) can impact the well-being of employees, the community, and customers. It must be rigorous and transparent in practice. And, while this makes sense, it is not always simple, yet it is an ESG requirement. Through an AM lens, however, it need not be considered a cost. It can be a value driver.

Here are some high-level examples of what AM principles can provide:

Criticality assessment is another essential element of AM. Rigorously determining the importance of assets is the basis for determining how to maintain, sustain, plan, and operate them effectively. The more critical an asset, the more rigorous its maintenance strategy, the more critical spares required, and the more detail in operating practice. Primary factors in determining criticality include:

In this way, AM and, more importantly, comprehensive asset management, are inextricably linked to ESG goals and objectives.

Criticality is the primary input to the design of a safety system, environmental program, and maintenance strategy, as well as risk determination.

Asset condition (health or likelihood of failure), along with criticality, determines asset risk (Criticality * Condition). Given that ESG factors are key drivers in this formula, an organization’s ability to understand its assets in terms of risk is essential and a measure of its ESG maturity. From a broader perspective, it is a key determinant of an organization’s AM maturity and, more importantly, its ability to make rigorous and transparent risk-based decisions.

Risk-based decision making, enabled by criticality assessments and quality condition assessments (a function of maintenance strategy, by the way) is central to managing risks, performance, and profitability with due diligence and transparency.

Managing future challenges is an area of increasing focus for many businesses. As climate change impacts become better understood, businesses are turning their attention to climate adaptation in both business planning and operations. Climate adaptation will be an important feature in many businesses’ ESG tactics going forward.

Here are some key requirements to support climate adaptation planning:

Increasingly, businesses will need to have this competency in their organization to make the best medium- and long-term plans. For some, this will be an ESG strategy requirement. For others, it will be just good business. For all, it will require good AM discipline to get it right.

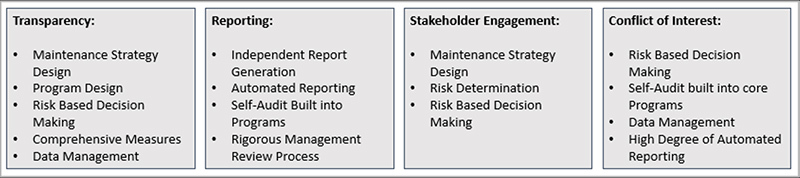

Governance, like environmental and social streams, has essential activities at the executive and board levels. However, to establish an ESG culture throughout an organization, it is necessary that principles and strategic goals are represented, applied, measured, and managed in all operational areas.

As detailed below, governance categories include:

While the categories of governance are obvious, operationalizing them, rigorously, is not simple and is not typically embedded within operational activities. In an ESG world, it is necessary to have the following in place:

These fundamentals are also common AM fundamentals and are necessary competencies for a business to move toward AM maturity.

It can be asserted that ESG development will help mature an organization’s AM competency. And a business should expect that AM maturation will advance its ESG goals while enhancing its performance and/or bottom line.

Fundamental to all these efforts is performance management.

Well-executed performance management provides the right intel to the right people in the organization. AM should have a streamlining effect and, importantly, reduce decision-making in processes. Of course, strategic decision-making is the realm of senior management, but AM enables an effective way to have high-quality decision-making throughout the organization’s business activities.

Consider the following examples of governance from an ESG and AM perspective: